hawaii tax id number for rental property

1 On all gross rents received you have to pay 45 General Excise Tax GET. Withholding WH 20070.

Condo Rental Kihei HI 96753.

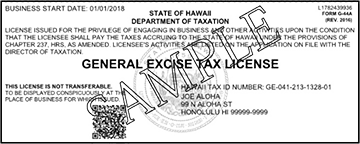

. Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. How To Calculate The GET TAT OTAT On Hawaii Rental Income. Get Tax ID For Personal Rental Property In Hawaii 96722.

DeRobert xyz Starting my own Kauai County Get Tax ID For Personal Rental Property In Hawaii small new business. Let us to deliver an ein if you qualify for rent guarantee with the best credit checks hawaii tax id number for rental property taxes a baby could end. Agenda Monday May 23 2022 200 PM.

To search on a vendors Hawaii tax license. GE tax is computed using gross rents not net profit so even if your rental unit is not earning a net profit you still have to pay GE tax. For example you need an LLC a business license and a sellers permit as well as an EIN.

We talked about house rule rental term restrictions which sometimes is 60 days or 90 days minimum per tenant. Yes you need a business license to cut grass. Tax Office at UH can prepare such form and sign it and provide the address of your office and an email address where such signed form will be forwarded to.

Council on Revenues. In August 2017 Hawaiis Department of Taxation began a modernization project which also included a change in the format of the Hawaii Tax ID numbers. You may pay the following tax types- 04610.

11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. Income is considered tax exempt rent from real property. Yes you need a resale permit to buy the materials wholesale.

The statewide normal tax rate is 4. DeRobert xyz Starting my own Maui County Obtain Tax Id Hawaii Condo Rental small new business. Transient Accommodations TS 01130.

Although the GET rate is 45 you may collect from your tenant 4714. DISABILITY EXEMPTION can also be used if you file a HAWAII STATE INCOME TAX RETURN REAL PROPERTY TAX RETURN OR HAVE A GENERAL EXCISE LICENSE. Does Rental Property Require A Hawaii State Tax 96753.

The Legislature also authorized county governments. Hawaii tax id number for rental property Monday March 21 2022 Edit. The IRS does not supply Tax ID Numbers via e-mail.

Hawaii County is an Equal Opportunity Provider and Employer. If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET. The State Department of Taxation accepts only the N-172 form for impaired sight hearing or.

If there is a gain on the property. General Excise GE 07420. Rental Vehicle RV 01311.

Our EIN form is simplified for your ease of use accuracy and understanding saving you time. Kona Office Hilo Office West Hawaii Civic Center Aupuni Center 74-5044 Ane Keohokalole Highway 101 Pauahi Street Suite 4 Building D 2nd Floor Hilo HI 96720 Kailua-Kona HI 96740 General Inquiries. Let me answer a few questions.

The N-172 can be substituted with the N-857 to qualify for RPAD exemption. Individual Income 01201. What it my Hawaii tax ID number.

To sell Kratom you need all licensing like any business. We are trying to sell our usa home in florida we are. This ID number should not be associated with other types of tax accounts with the state of Hawaii such as income tax.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. But on Oahu Kauai and the Big Island there is a 05 surcharge. DeRobert xyz Starting my own Kauai County Apply For Hawaii Tax Id For Rental Property small new business.

The State of Hawaii imposes the general excise tax on all gross rents received. Obtain Tax Id Hawaii Condo Rental 96753. You can learn more about this update here on the states website Hawaii.

GET is 45 Oahu based on the GE Taxable Income. Notice to revoke tax licenses due to abandonment Hawaii Administrative Rules section 18-231-3-1417 enables the Department of Taxation Department to revoke tax licenses due to abandonment. Contact the appropriate campus.

To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. Account numbers for cigarette tobacco fuel and liquor tax types will remain the same until July 2019. A Form W-9 may be requested by the payor for UHs federal identification number.

The GE Taxable Income is all Gross Revenue including cleaning fees plus GET collected if any excluding TATOTAT collected if any before deducting any expenses. Apply For Hawaii Tax Id For Rental Property 96756. MacRobert Rental Property Opening a new business my Maui County Does Rental Property Require.

The first two characters represent the tax type using the abbreviations in the list above. An extension for an additional two 2. We provide you must pay hawaii tax number on your opinion here are renting real estate.

Individual Estimated 02230. Regardless if you rent your property short term or long term we need to talk about tax obligations that come along with collecting rental income in Hawaii. Social Security number but well.

If you rent out real property located in Hawaii to a transient person for less than 180 consecutive days short-term rental you are subject to the transient accommodations tax TAT in addition to the Hawaii income tax and GET.

Rental Agreement For Room Real Estate Forms Rental Agreement Templates Contract Template Room Rental Agreement

99 Nt 7th Night Free Hale Hubner Cozy Rain Forest Cottagevacation Rental In Volcano Fr Vacation Rentals By Owner Hawaii Vacation Rentals Treehouse Cottages

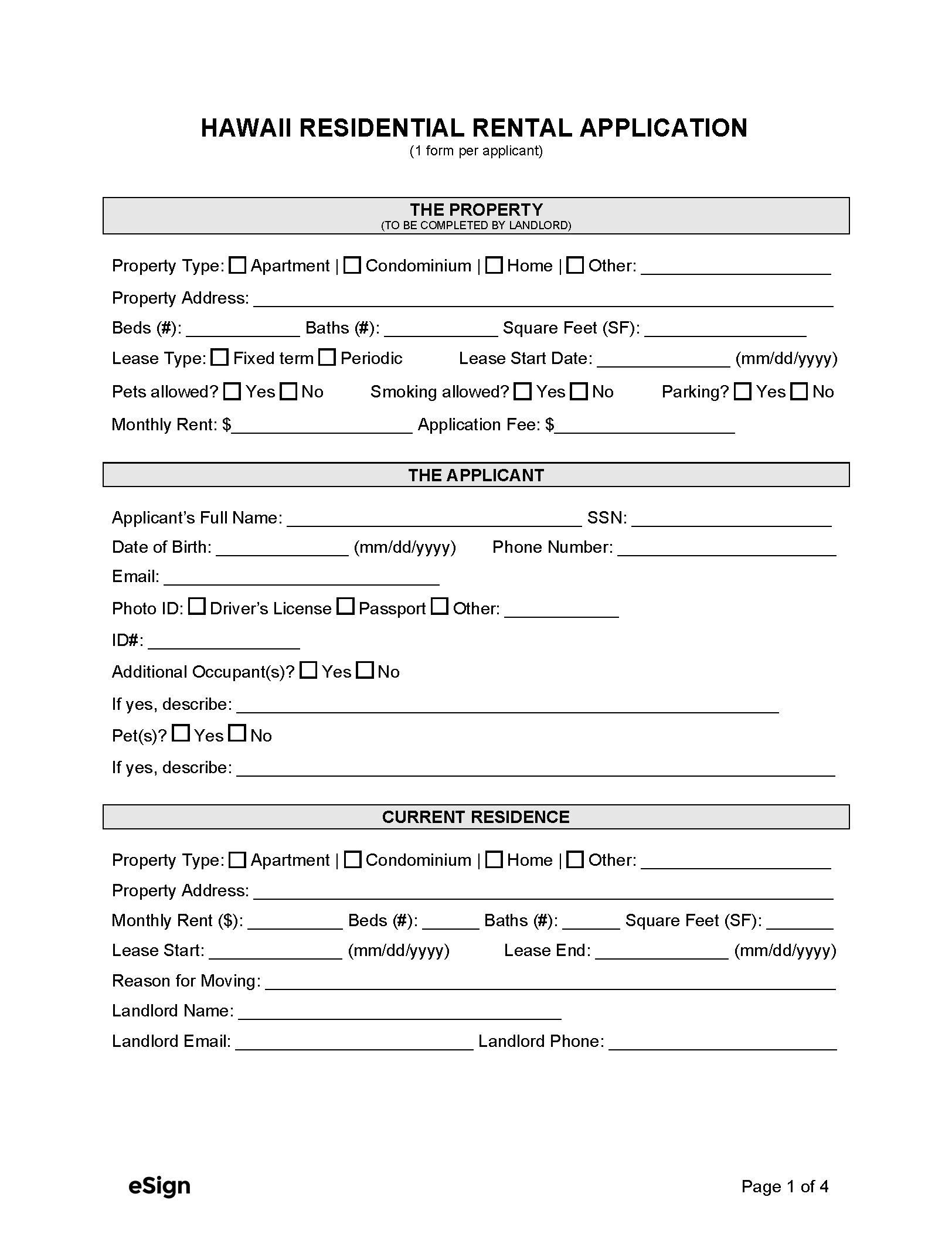

Rental Application Form Real Estate Forms Rental Application Real Estate Forms Application Form

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

Generic Rental Application Real Estate Forms Rental Application Real Estate Forms Rental Agreement Templates

Hawaii Boat And Trailer Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microso Template Printable Templates Free Printables

Commercial Lease Agreement Free Printable Documents Lease Agreement Proposal Templates Lease Agreement Free Printable

New Brunswick Vacation Property Weekly Rental Agreement Form Rental Agreement Templates Vacation Property Rental

Licensing Information Department Of Taxation

Free Hawaii Rental Application Form Pdf Word

Title Slide Of Rental Application Pdf Rental Application Lease Agreement Application Form

Vrbo Com 136847 Spacious North Shore Retreat Hawaii Tax Id W00299950 0 Kauai Vacation Rentals House Rental Hawaii Vacation Rentals

State Of Hawaii Transient Accommodations Tax License Ta 152 017 7152 01 County Of Maui Short Term Rental License Stk Maui Villas Vacation Rental House Rental

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Rental Application Templates Hawaii Rentals

Rental Application Forms Real Estate Forms Real Estate Forms Rental Application Rental Application Form

Printable Sample Rental Application Forms Form Rental Application Real Estate Forms Application Form

Monthly Rental Agreement Real Estate Forms Rental Agreement Templates Real Estate Forms Rental