car lease tax deduction calculator

Finally add GST and PST or HST to 30000 and multiply this amount by your total lease charges for the year and divide the total by the. Car Lease Car Lease Calculator.

Potential 2020 Business Vehicle Tax Deduction Bismarck Motor Company

Your estimated IRS mileage deduction is 34500 over the course of your lease.

. Car Leasing Company Car Through Business. Max refund is guaranteed and 100 accurate. VAT - Monthly Lease inc.

Find Out What You Need To Know - See for Yourself Now. Calculating your total mileage deduction To use the example above lets say your total business mileage for the year is 8000 4000 from January to June and another 4000 from July to the end of the year. 800 13 x 181 30 5454.

Your mileage deduction would be 4840. If you claimed your lease payments last year subtract last years amount line 20. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Enter this number on line 24. Ad The Best Alternatives to Car Lease Calculator. If you decide to take out a business car lease you could claim back up to 100 of the tax.

Ad All Major Tax Situations Are Supported for Free. 30000 100 85 35294 Prescribed deductible leasing costs limit 800 GST and PST on 30000 3900 GST and PST on 35294 4588 GST and PST on 800 104. You can calculate taxable value using commercial payroll software.

For others they can no longer make monthly lease. Number of days in 2021 she leased the car 184 Prescribed CCA capital cost limit 30000 Prescribed CCA capital cost limit Prescribed limit rate. You need to keep records Where you and another joint owner use the car for separate income-producing purposes you can each claim up to a maximum of 5000 business kilometres.

Try the calculator out below to see how the taxes and differences work out. We researched it for you. Car Lease Tax Deduction Calculator.

Start Your Tax Return Today. This makes the total lease payment 74094. Divide the depreciation amount by the number of months in your lease.

With business leasing youll usually be required to pay tax that is calculated from the cars CO2 emissions the P11D value list price of the car and your personal income tax bracket. Calculate Tax Over Lease Term. But its not all doom and gloom as there are savings to be made.

Lease payments insurance costs. Tally your car lease costs Add up all the costs associated with your leased car. VAT - Vehicle P11d Value - Vehicle BIK Percentage - more options.

Multiply the base monthly payment by your local tax rate. An auto leasing industry term for expressing the interest rate used to calculate the monthly lease payment and equal to the leases APR divided by 2400. Enter your gross business profits below - VAT Registered Business.

However if your total itemized deductions dont exceed the standard deduction 12200 for single filers and 24400 for those married filing jointly you may choose not to itemize at all in which case you cant deduct the sales tax you pay on your vehicle lease or purchase. In this case the formula will look like this. Thats because 4000 times 0585 is 2340 and 4000 times 0625 is 2500.

For example maybe the renters family has grown and the 2-seater convertible is not big enough or because of a new longer ride they want a more fuel-efficient vehicle. Or you can use HMRC s company car and car fuel benefit calculator if it works in. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment.

Car leasing as a business owner. Lease Summary Amount Borrowed 6500 Total MSRP 20000 Residual Value - 11000 Down Payment - 2500 Trade-In Value - 0 Total Amount Borrowed 6500 Monthly Payment 215 Base Monthly Payment 181 Estimated Monthly Fees 34 Estimated Monthly Taxes 0 Total Monthly Payment 215 Due at Signing 2749 Shop Leases in Your Budget. Discover Helpful Information And Resources On Taxes From AARP.

This will be your base payment. Another common reason is a lifestyle change. Add the adjusted capitalized cost and the residual value.

To calculate your deduction multiply the number of business kilometres you travel in the car by the appropriate rate per kilometre for that income year. Free means free and IRS e-file is included.

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

Commercial Vehicle Tax Deductions Diehl Of Moon

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

What Are Tax Deductible Car Expenses Gofar

Writing Off A Car Ultimate Guide To Vehicle Expenses

Is Buying A Car Tax Deductible Lendingtree

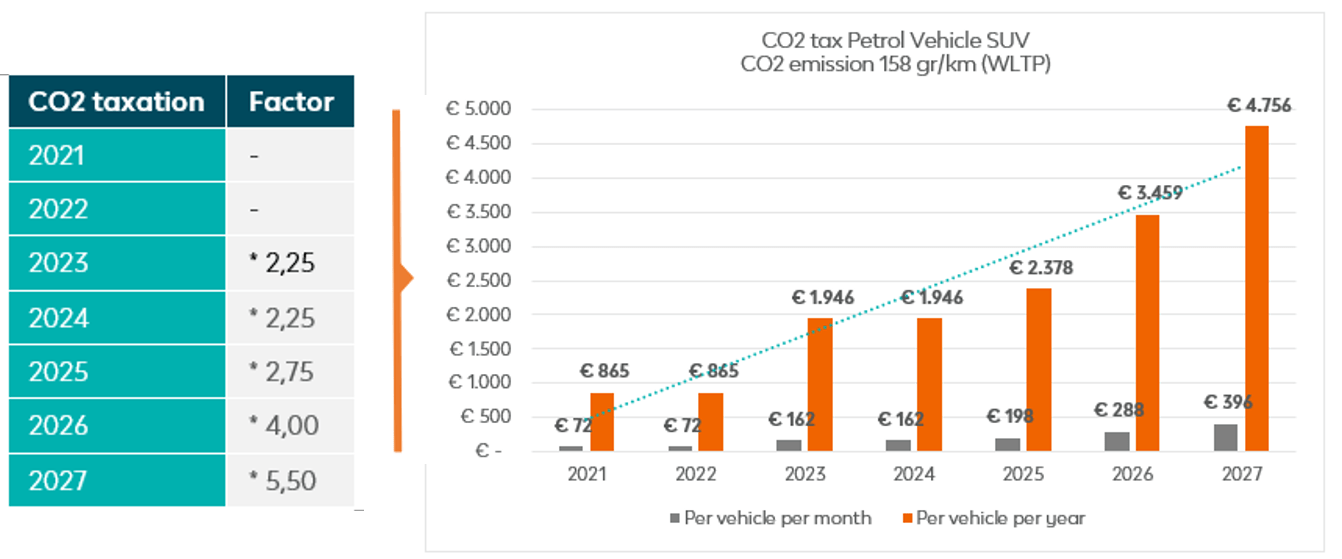

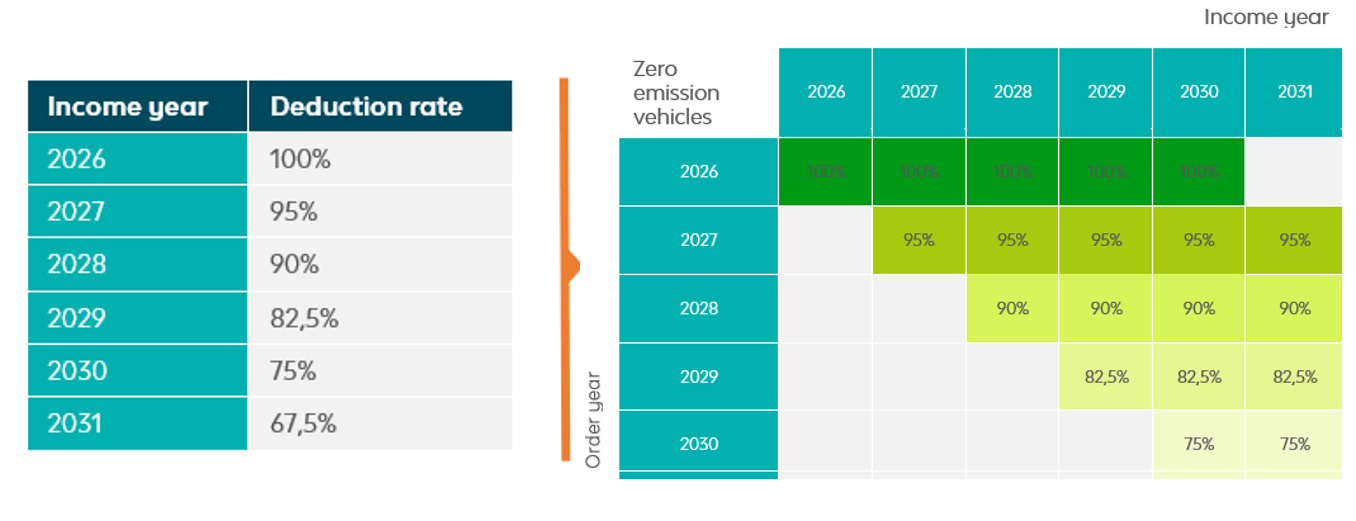

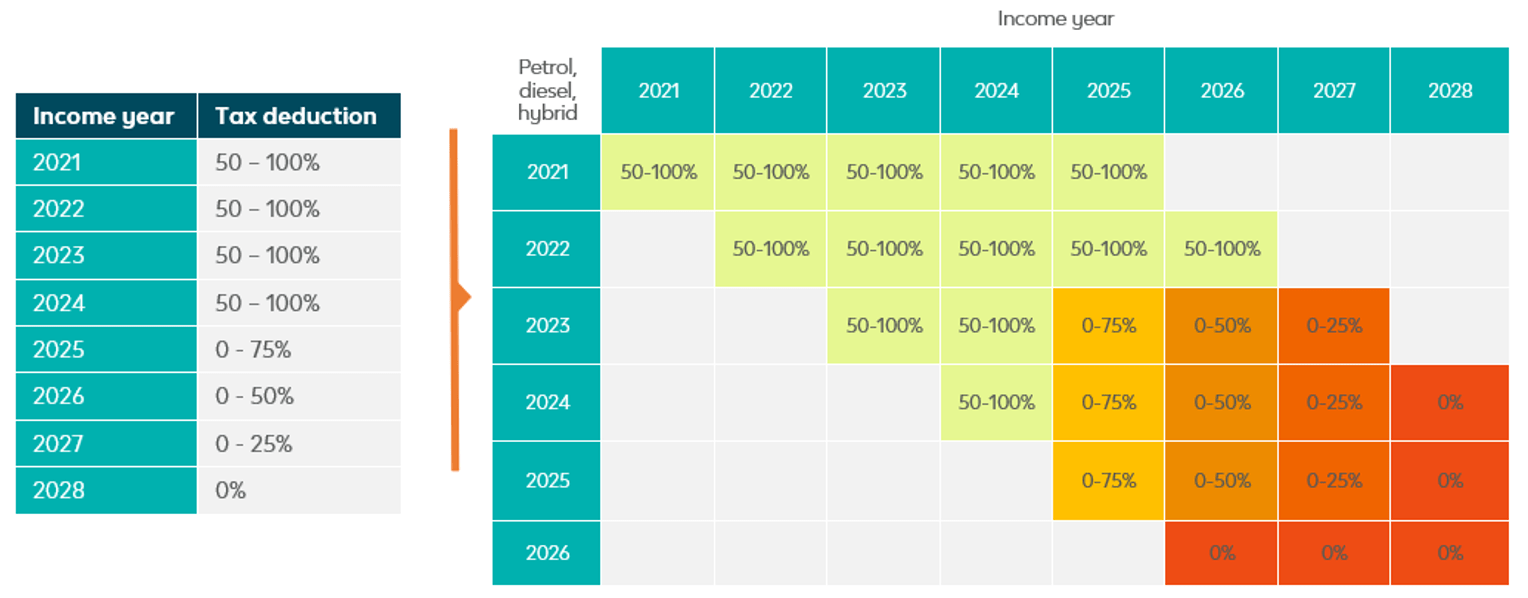

Vehicle Tax Focus On A Greener Company Car Fleet Leaseplan

Vehicle Tax Focus On A Greener Company Car Fleet Leaseplan

Real Estate Lead Tracking Spreadsheet Fresh Tax Deduction Spreadsheet Paso Evolist Documents Ideas

Car Expenses What You Can And Cannot Claim As Tax Deductions

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Vehicle Tax Deductions How To Write Off Car And Truck Expenses

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Vehicle Tax Focus On A Greener Company Car Fleet Leaseplan

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Best Vehicle Tax Deduction 2022 It S Not Section 179 Deduction Youtube

Vehicle Tax Deduction 8 Cars You Can Get Tax Free Section 179 Youtube

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense